RISING Foreclosure Rates!

- What is Foreclosure?

- How Foreclosures Impact Home Buyers in New Jersey

- How Foreclosures Impact Home Sellers in New Jersey

- What You Can Do

- Making an Offer on a Foreclosed Home

- How Sellers Can Stay Competitive

- How Jeff Buys Houses Cash Can Help

- Navigating Rising Foreclosure Rates in New Jersey and Pennsylvania: Expert Guidance from Jeff Buys Houses Cash

It’s no secret that FORECLOSURE rates in America are on the rise…

This can affect the New Jersey real estate market in all sorts of ways.

“The housing market has always been a volatile industry.”

With fluctuating prices, ever-changing regulations, and unforeseeable economic conditions, it can be challenging for homebuyers and home sellers to navigate the market successfully.

One of the most significant factors that can impact the housing market is foreclosure rates.

When foreclosure rates rise, it can have a significant impact on both homebuyers and home sellers.

Are you thinking of buying or selling a house in New Jersey?

Here’s what rising foreclosure rates may mean for you.

What is Foreclosure?

Foreclosure rates are a measure of the number of homes that have been repossessed by lenders due to the homeowner’s inability to pay their mortgage.

When foreclosure rates rise, it can indicate an economic downturn, a rise in unemployment rates, or an increase in interest rates.

Regardless of the cause, rising foreclosure rates can lead to a drop in home prices, which can impact both home buyers and home sellers.

How Foreclosures Impact Home Buyers in New Jersey

For homebuyers, rising foreclosure rates can be both a blessing and a curse.

On the one hand, it can mean that there are more affordable homes on the market.

Foreclosed homes are often sold at a discount, making them an attractive option for homebuyers on a budget.

However, foreclosed homes can also come with a lot of baggage…

Many foreclosed homes are in disrepair, and the previous owners may have neglected them or stripped them of valuable fixtures and appliances.

Additionally, buying a foreclosed home can be a lengthy and complicated process, as the bank or lender that repossessed the home will need to approve the sale.

How Foreclosures Impact Home Sellers in New Jersey

For home sellers, rising foreclosure rates can be a cause for concern.

As more homes are foreclosed upon, there may be an increase in the number of distressed sales on the market.

Distressed sales are when a seller is forced to sell their home quickly, often at a loss, due to financial hardship.

These sales can drive down home prices in the area, making it harder for other sellers to get the price they want for their homes.

Additionally, if a home seller is facing foreclosure themselves, they may be forced to sell their home at a loss to avoid losing it to the bank.

What You Can Do

Ultimately, rising foreclosure rates can impact both home buyers and home sellers in different ways.

However, there are steps that both parties can take to navigate the market successfully during these challenging times.

Making an Offer on a Foreclosed Home

For homebuyers, it’s important to do your research before making an offer on a foreclosed home.

Work with a real estate agent who has experience in the foreclosure market, and be prepared for a potentially lengthy and complicated process.

Make sure to get a thorough inspection of the property before making an offer, and be prepared to invest time and money into repairs and renovations if necessary.

How Sellers Can Stay Competitive

For home sellers in New Jersey, it’s essential to stay competitive in the market.

This may mean pricing your home competitively or making necessary repairs and upgrades to attract buyers.

Additionally, if you’re facing foreclosure, it’s important to work with your lender to explore all of your options.

This may include a short sale, where you sell your home for less than what you owe on your mortgage, or a loan modification, where your lender adjusts the terms of your mortgage to make it more affordable.

How Jeff Buys Houses Cash Can Help

Jeff Buys Houses Cash is unique in that we work with both buyers and sellers to facilitate deals in which everyone comes out ahead.

We help local homeowners by offering a great price for their homes, stopping the foreclosure process almost immediately.

Instead of losing their homes to the bank, homeowners are able to walk away from the frustrating property with a check in hand.

Rising foreclosure rates can be a cause for concern for both home buyers and home sellers.

However, with careful research, preparation, and strategic decision-making, it’s possible to navigate the market successfully during these challenging times.

Whether you’re looking to buy or sell a home, it’s important to work with a trusted real estate agent who can guide you through the process and help you make informed decisions.

With the right approach, you can achieve your homeownership goals, even in the face of rising foreclosure rates.

Foreclosure rates are up since the pandemic, but Jeff Buys Houses Cash is here to offer solutions.

We can help homeowners sell before the foreclosure process begins.

We can also help foreclosure buyers by finding properties and facilitating deals.

To learn more about us and what we can offer don’t hesitate to reach out!

We’re happy to answer any questions you have about foreclosure properties in New Jersey. (856) 281-1157

Navigating Rising Foreclosure Rates in New Jersey and Pennsylvania: Expert Guidance from Jeff Buys Houses Cash

As a real estate investor from New Jersey, I’ve witnessed firsthand the impact of foreclosure rates on homeowners and buyers in our region.

The recent surge in foreclosures has left many wondering how to navigate this complex and often daunting process.

That’s where “Jeff Buys Houses Cash” comes in – an experienced and reputable we buy houses company dedicated to helping property buyers and sellers in New Jersey and Pennsylvania find their way through the rising foreclosure rates.

With over 35+ years of experience in investing, foreclosure, and construction trade, Jeff has developed a unique understanding of the foreclosure landscape.

His expertise extends beyond traditional real estate solutions, offering customized ‘foreclosure solutions that work’ for individuals facing foreclosure or seeking to capitalize on foreclosure opportunities.

Understanding Rising Foreclosure Rates

Before diving into solutions, it’s essential to grasp the underlying factors contributing to rising foreclosure rates in New Jersey and Pennsylvania

- Economic uncertainty and job insecurity

- Increasing mortgage rates and loan defaults

- Decline in housing market values

- Overwhelming medical or financial burdens

These factors have led to a significant increase in foreclosure filings, leaving many homeowners overwhelmed and uncertain about their next steps.

How Jeff Buys Houses Cash Can Help

As a seasoned expert in foreclosure navigation, Jeff offers comprehensive guidance and support to:

Homeowners facing foreclosure

Jeff provides personalized counsel on:

- Avoiding foreclosure through loan modifications or refinancing

- Exploring government assistance programs (e.g., FHA, VA, and USDA)

- Negotiating with lenders for temporary payment suspensions or reductions

Buyers seeking foreclosure opportunities

Jeff helps investors:

- Identify and capitalize on undervalued properties

- Navigate the foreclosure auction process

- Develop strategies for rehabbing and flipping properties

Sellers needing quick property sales

Jeff facilitates:

- Fast, cash-based transactions

- As-is property purchases, eliminating repair costs

- Confidential, hassle-free sales

Proven Strategies for Navigating Rising Foreclosure Rates

Drawing from his extensive experience, Jeff recommends the following approaches:

- Stay informed: Monitor local market trends, foreclosure rates, and legislative changes.

- Seek professional advice: Consult with experts like Jeff to explore available options.

- Act promptly: Don’t delay in addressing foreclosure concerns or pursuing opportunities.

- Diversify investments: Spread risk across various asset classes, including real estate.

- Leverage technology: Utilize online platforms and tools to streamline property searches and transactions.

Success Stories and Testimonials

Numerous clients have benefited from Jeff’s expertise, achieving:

- Avoided foreclosures through successful loan modifications

- Profitable investments in undervalued properties

- Stress-free, quick property sales

Take Action Today

If you’re struggling with rising foreclosure rates in New Jersey or Pennsylvania, don’t hesitate to reach out to Jeff Buys Houses Cash.

Take the first step toward navigating this complex landscape:

- Call Jeff directly to discuss your situation

- Fill out the online form for a prompt response

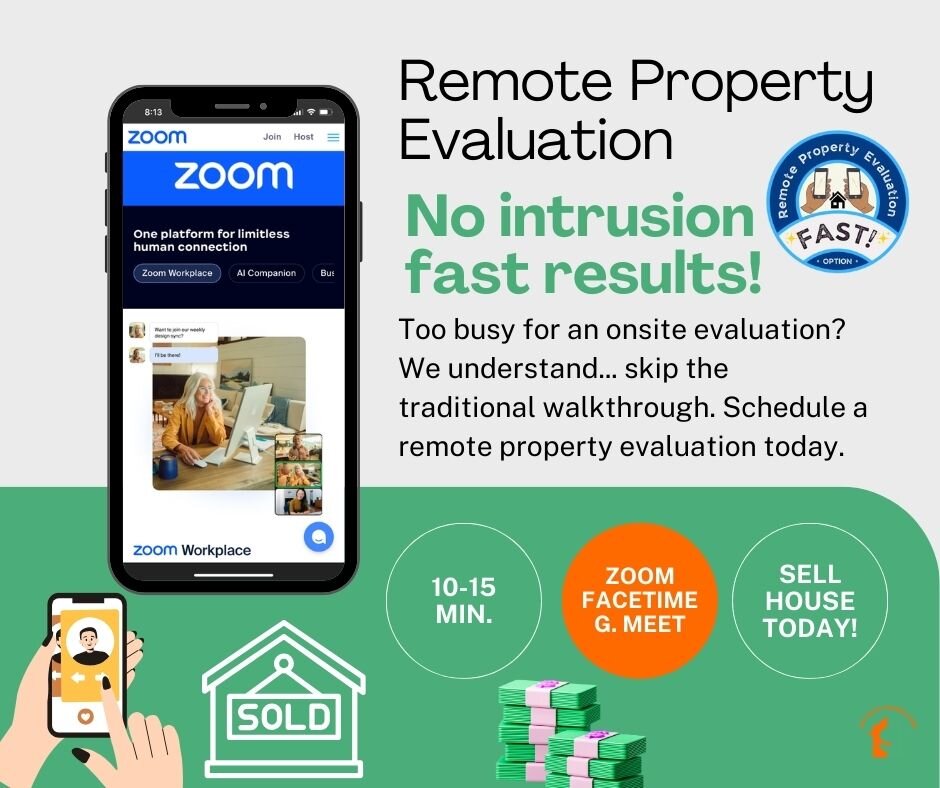

- Schedule a remote property evaluation for personalized guidance

With Jeff’s 35+ years of experience and proven track record, you can trust that you’re in capable hands.

Don’t let foreclosure rates overwhelm you – seek expert advice and take control of your financial future.

Conclusion

Foreclosure rates in New Jersey and Pennsylvania require prompt attention and expert guidance.

Jeff Buys Houses Cash is dedicated to helping homeowners and buyers navigate this challenging landscape.

By leveraging Jeff’s extensive experience and customized solutions, individuals can:

- Avoid foreclosure and protect their financial well-being

- Capitalize on foreclosure opportunities and grow their investments

- Achieve stress-free property sales and purchases

Remember, navigating rising foreclosure rates demands proactive measures.

Contact Jeff Buys Houses Cash today to ensure a smoother, more secure path forward.

Schedule A Remote Property Evaluation Today

Are you trying to sell a house, but you don’t have time for a walkthrough or showing? No problem. Just schedule a remote property evaluation… Choose Zoom, Facetime, or Google Meet. We only need 10 – 15 minutes of your time, to get the information needed to give you a cash offer within 24 hrs. What are you waiting for? Schedule your remote property evaluation now.