Are you trying to sell your house during bankruptcy, to avoid losing it in foreclosure?

- Court Permission

- Contingency

- Proceeds

- Planned Payments

- Itemized Payoff Statement

- Jeff Buys Houses Cash

- Selling Your House During Bankruptcy: Weighing the Pros and Cons of Using a ‘We Buy Houses’ Company

If you own a home when you file for bankruptcy, it becomes part of the bankruptcy estate, the property or assets you own.

In October of 2022, there was a twenty-seven percent increase in Chapter 13 bankruptcy filings over the previous year.

Bankruptcies, including all chapters, total a seven percent increase overall, which correlates strongly with the seven percent increase in inflation.

Many homeowners are overwhelmed by their debt…

As financial issues due to circumstances beyond their control changed their ability to pay creditors, they found they had no option but to claim bankruptcy, which could stop a foreclosure on their primary residence.

Get An Offer Today, Sell In A Matter Of Days

Those with secured and unsecured debts totaling less than $2,750,000 are eligible for Chapter 13.

However, chapter 7 is a liquidation process in which the trustee sells your assets to pay debts based on your total income, debt, and ability to repay.

Often, these homeowners want to sell their houses to solve at least some of their financial difficulties but wonder if it is possible during bankruptcy proceedings.

While the rules for the process may differ for the type of bankruptcy you file under, and many factors influence the final determination, for most homeowners, the short answer is YES!

So read on as we explore how to sell your house during bankruptcy in New Jersey.

Please note that this article is for informational purposes only and does not provide financial or legal advice.

Court Permission

You’ll need to file a motion with the court for leave to sell real property or approval to sell your house during bankruptcy in New Jersey.

You will want to include the selling price, your plans for the proceeds, and names of creditors holding liens on the property.

This motion allows your creditors and any trustee to object, and the court will determine the disbursement of any funds.

Contingency

In a traditional sale, you’ll need to add a contingency clause to the contract to sell your house during bankruptcy in New Jersey, stating that the sale is contingent upon obtaining bankruptcy court permission.

However, under Chapter 7, the trustee may determine to sell the house if your home has high unprotected equity under your bankruptcy exemption.

With the funds, the trustee pays any secured debts like the mortgage, provides you with the exempted amount you are entitled to, and then satisfies any unsecured creditors with a pro ratio share of any remaining funds.

Proceeds

You may wonder what happens to any proceeds after the mortgage is satisfied when you sell your house during bankruptcy in New Jersey.

Of course, much will depend on your homestead exemption.

However, the proceeds will likely go towards paying any remaining unsecured creditors or paying for the bankruptcy case.

Planned Payments

Under Chapter 13, if you sell your house during bankruptcy in New Jersey, you will need to modify your planned payments.

Depending on the realized sale value, you may pay your plan off earlier as the proceeds go directly towards the bankruptcy.

Itemized Payoff Statement

To ensure no fees remain to surprise you after you sell your house during bankruptcy in New Jersey, you should request an itemized payoff statement.

Jeff Buys Houses Cash

Don’t hesitate!

With competition still driven by low supply and rising interest rates on the horizon, now is the time to cash in on your house, and the best way to sell your house during bankruptcy in New Jersey is to sell directly to the cash investors at Jeff Buys Houses Cash.

Our policy at Jeff Buys Houses Cash is full transparency through every step of the process because we want you to decide which sales method works best for your situation.

To that end, a cash investor from Jeff Buys Houses Cash will detail your expenditures and potential profits from a conventional listing with an agent, vs. our offer, which you’ll agree is fair.

At Jeff Buys Houses Cash, we do this because we are your neighbors here in New Jersey, we care about our community and the people in it, and we want you to feel good about working with us long after the deal is closed.

The seasoned pros at Jeff Buys Houses Cash have experience with sellers going through bankruptcy and have the solution you seek, providing you with a guaranteed closing date, charging no commissions or closing costs with no unpleasant surprises.

If you’d like to avoid the work and out-of-pocket costs of prepping your house to list on the New Jersey real estate market, a direct sale to the cash investors at Jeff Buys Houses Cash is the solution.

The cash investors at Jeff Buys Houses Cash never charge commissions, and there are no hidden fees.

So you can put your wallet away and relax; you won’t even need to worry about showings when you make a direct sale to a cash investor from Jeff Buys Houses Cash.

For a no-hassle sale of your home during bankruptcy: a cash investor from Jeff Buys Houses Cash will buy your house directly, as-is, for cash. Call Jeff Buys Houses Cash at (856) 281-1157.

Need To Sell Your Cherry Hill Area House Fast?

Get Your Fair Cash Offer Below Or (856) 281-1157 Today!

Click here to fill out the Inquiry form and receive an unbeatable cash offer for your home.

Selling Your House During Bankruptcy: Weighing the Pros and Cons of Using a ‘We Buy Houses’ Company

Download Your FREE “Pros, Cons, and Pitfalls” Guide Below

Just put in your name and email, click “Submit” and we’ll email you the Free Guide right away.

When facing bankruptcy, selling your house can be a daunting task.

You may be struggling to keep up with mortgage payments, and the thought of adding real estate agent fees to your financial burdens can be overwhelming.

This is where ‘we buy houses’ companies come in – promising to purchase your property quickly and for cash.

But, like any industry, there are pros and cons to consider, as well as potential rip-offs to watch out for.

In this article, we’ll explore the advantages and disadvantages of using a ‘we buy houses’ company to sell your house during bankruptcy.

We’ll also discuss common scams in New Jersey and Pennsylvania, and how to identify a reputable company like Jeff Buys Houses Cash.

Pros of Using a ‘We Buy Houses’ Company

- Quick Sale: ‘We buy houses’ companies can purchase your property in as little as 7-10 days, providing a swift solution to your financial woes.

- No Real Estate Agent Fees: By cutting out the middleman, you can save thousands of dollars in commission fees.

- Cash Offer: Reputable ‘we buy houses’ companies offer cash for your property, eliminating the need for financing approvals.

- No Repairs Needed: These companies typically purchase properties in their current condition, saving you money on repairs and renovations.

Cons of Using a ‘We Buy Houses’ Company

- Lower Sale Price: ‘We buy houses’ companies often offer lower prices than traditional buyers, as they need to make a profit on the resale.

- Lack of Transparency: Some companies may not clearly disclose their fees or sale terms, leaving you with unexpected costs.

- Risk of Scams: As with any industry, there are dishonest ‘we buy houses’ companies that prey on vulnerable homeowners.

Common ‘We Buy Houses’ Rip-Offs in New Jersey and Pennsylvania

- Lowball Offers: Scammers may offer significantly lower prices than market value, taking advantage of homeowners’ desperation.

- Hidden Fees: Some companies may charge exorbitant fees for services like inspections or appraisals, eating into your sales profits.

- Contract Tricks: Dishonest companies may include clauses that allow them to back out of the sale or reduce the offer price at the last minute.

Bad Actors in Every Industry

It’s essential to remember that dishonesty isn’t unique to ‘we buy houses’ companies.

Every industry has its share of bad actors, from corrupt lawyers to unscrupulous contractors.

The key is to research and carefully select a reputable company.

Jeff Buys Houses Cash: A Reputable ‘We Buy Houses’ Company

At Jeff Buys Houses Cash, we understand the challenges of selling your house during bankruptcy.

With over 35+ years of problem-solving, real estate investing, and construction trade experience, our founder Jeff has developed creative solutions to help homeowners in bankruptcy.

Our 100% Satisfaction Guaranteed ‘cash for houses’ program ensures a smooth and stress-free sale.

How Jeff Buys Houses Cash Works

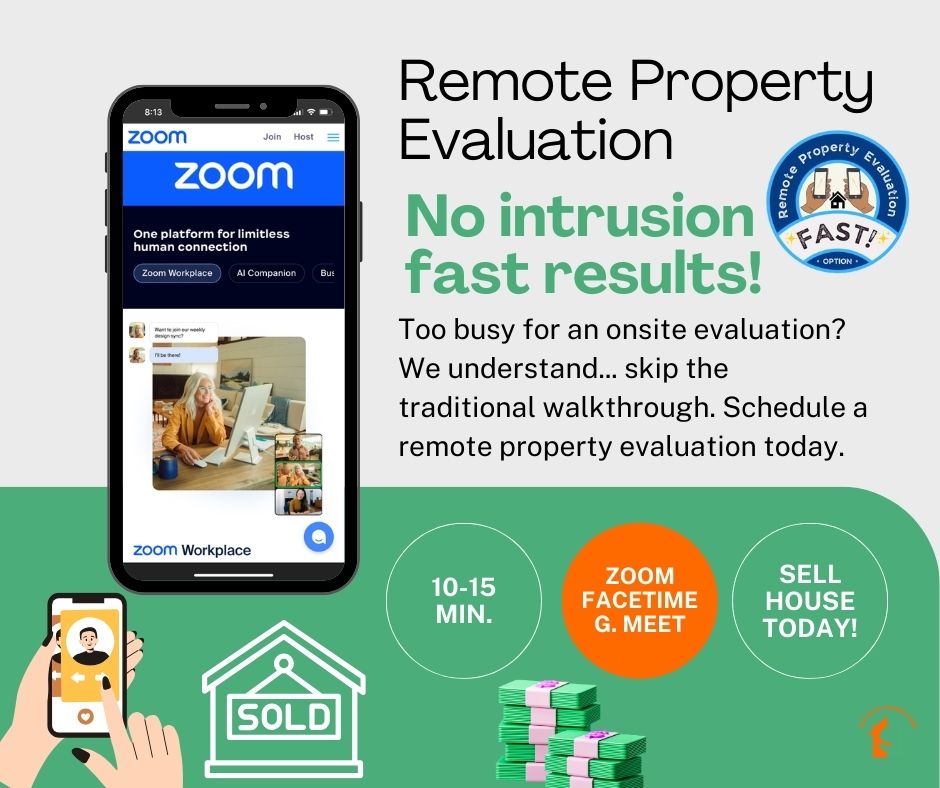

- Contact Us: Reach out to us via phone, online form, or schedule a ‘remote property evaluation’ to discuss your situation.

- Customized Solution: We’ll work with you to create a personalized sale plan, addressing your specific needs and concerns.

- Cash Offer: We’ll provide a fair, cash offer for your property, with no hidden fees or surprises.

- Quick Closing: We’ll guide you through the sale process, ensuring a swift and hassle-free closing.

Schedule A Remote Property Evaluation Today

Are you trying to sell a house, but you don’t have time for a walkthrough or showing? No problem. Just schedule a remote property evaluation… Choose Zoom, Facetime, or Google Meet. We only need 10 – 15 minutes of your time, to get the information needed to give you a cash offer within 24 hrs. What are you waiting for? Schedule your remote property evaluation now.

Conclusion

Selling your house during bankruptcy can be a complex and overwhelming process.

While ‘we buy houses’ companies offer a convenient solution, it’s crucial to weigh the pros and cons and beware of potential scams.

By choosing a reputable company like Jeff Buys Houses Cash, you can ensure a smooth and stress-free sale.

Don’t hesitate to contact us today to learn more about our ‘cash for houses’ program and how we can help you sell your house during bankruptcy in New Jersey and Pennsylvania.

Remember, our goal is to provide a win-win solution for homeowners in bankruptcy.

We’re committed to transparency, honesty, and customer satisfaction.

Let us help you navigate the challenges of selling your house during bankruptcy and achieve a fresh start.

Additional Resources

If you’re facing bankruptcy and need guidance on selling your house during bankruptcy, we recommend consulting with a financial advisor or bankruptcy attorney.

Additionally, you can contact us directly to discuss your situation and explore our ‘cash for houses’ program.